SVPAA Budget & Finance

Budget Model Basics:

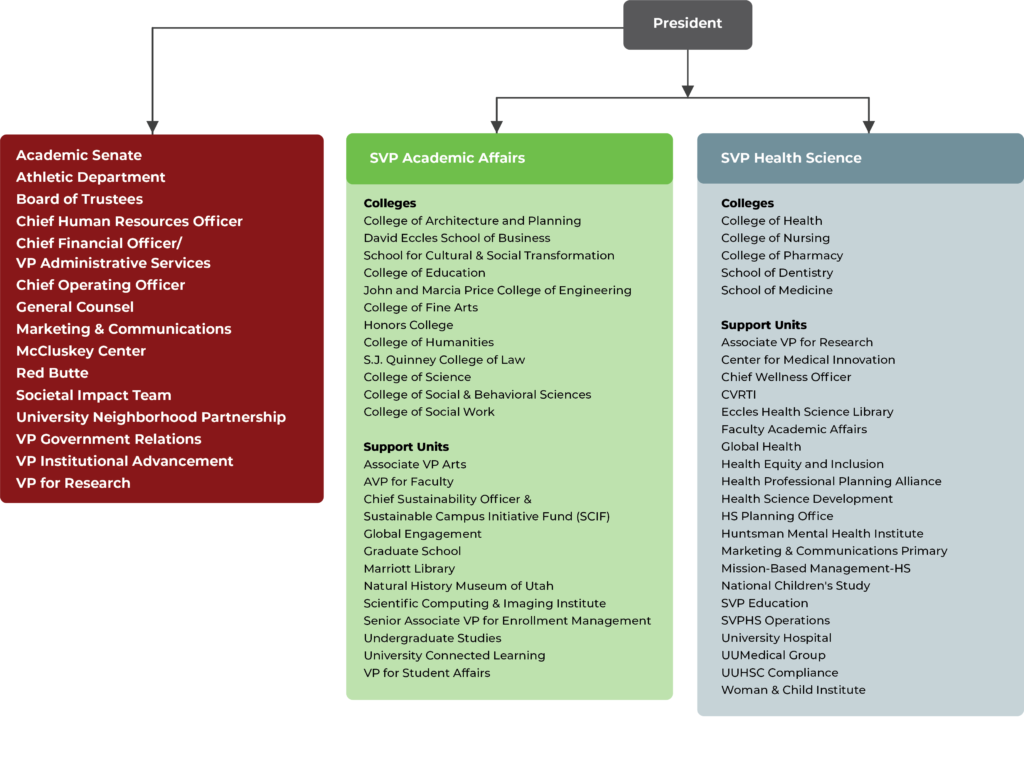

Senior Vice President for Academic Affairs Reporting Units

The University of Utah main campus colleges reporting to the SVPAA use a hybrid incremental base and incentive-based budget model, with a few exceptions. The incentive portion represents a small percentage of the overall allocation. Currently, colleges receive most of their funding from two revenue sources, state appropriations and general tuition, which are collected centrally and distributed to the colleges with guidance from the Office of the Senior Vice President for Academic Affairs (SVPAA) via base funding. Colleges may receive differential tuition directly and additional support funding from central administration.

Service and support units reporting to the SVPAA use an activity informed budget model, which links funding to activities that contribute to the institutional goals. These units operate on an annually approved budget or "authorized spend": base funding is held and managed centrally, and the budget or authorized spend is determined every year through the annual budget process.

The SVPAA budget model is exclusively focused on tuition and state appropriations. Research grants, donations and earned interest from endowments are managed within each college or unit. Returned overhead is collectively managed by the Senior Vice President for Academic Affairs, Senior Vice President for Health Sciences, Chief Financial Officer and Vice President for Research.

Funds typically flow from the state (appropriations) and central administration (tuition) to the Office of the SVPAA. Based on each reporting unit’s Academic Enterprise Plan and budget documents, the SVPAA allocates funding to the dean or appropriate vice president/provost. Deans and vice presidents/provosts then distribute funds within their colleges or service units.

State Funds Flow

See key terms and definitions below.

SVPAA Colleges, Service and Support Units

Click on a bar below to show a list of the colleges or service/support units which report to the Senior Vice President for Academic Affairs.

-

- College of Architecture and Planning

- David Eccles School of Business

- School for Cultural & Social Transformation

- College of Education

- John and Marcia Price College of Engineering

- College of Fine Arts

- Honors College

- College of Humanities

- S.J. Quinney College of Law

- College of Science

- College of Social & Behavioral Sciences

- College of Social Work

-

- Associate VP Arts

- AVP for Faculty

- Chief Sustainability Office

- Sustainable Campus Initiative Fund (SCIF)

- Global Engagement

- Graduate School

- Marriott Library

- Natural History Museum of Utah

- Scientific Computing & Image Institute

- Senior Associate VP for Enrollment Management

- Undergraduate Studies

- University Connected Learning

- VP for Student Affairs

Budget Reporting Structure

This figure shows how funds are distributed within the colleges and divisions/service units at the university. The relevant dean, vice president or vice provost accepts funds on behalf of the college or service unit and distributes those funds according to the college or unit’s internal budget and strategic planning process.

- Academic Senate

- Athletic Department

- Board of Trustees

- Chief Human Resources Officer

- Chief Financial Office/VP Administrative Services

- Chief Operating Officer

- General Counsel

- Marketing & Communications

- McCluskey Center

- Red Butte

- Societal Impact Team

- University Neighborhood Partnership

- VP Government Relations

- VP Institutional Advancement

- VP for Research

Colleges

- College of Architecture and Planning

- David Eccles School of Business

- School for Cultural & Social Transformation

- College of Education

- John and Marcia Price College of Engineering

- College of Fine Arts

- Honors College

- College of Humanities

- S.J. Quinney College of Law

- College of Science

- College of Social & Behavioral Sciences

- College of Social Work

Support Units

- Associate VP Arts

- AVP for Faculty

- Chief Sustainability Officer & Sustainable Campus Initiative Fund (SCIF)

- Global Engagement

- Graduate School

- Marriott Library

- Natural History Museum of Utah

- Scientific Computing & Imaging Institute

- Senior Associate VP for Enrollment Management

- Undergraduate Studies

- University Connected Learning

- VP for Student Affairs

Colleges

- College of Health

- College of Nursing

- College of Pharmacy

- School of Dentistry

- School of Medicine

Support Units

- Associate VP for Research

- Center for Medical Innovation

- Chief Wellness Officer

- CVRTI

- Eccles Health Science Library

- Faculty Academic Affairs

- Global Health

- Health Equity and Inclusion

- Health Professional Planning Alliance

- Health Science Development

- HS Planning Office

- Huntsman Mental Health Institute

- Marketing & Communications

- Primary Mission-Based Management-HS

- National Children's Study

- SVP Education

- SVPHS Operations

- University Hospital

- UUMedical Group

- UUHSC Compliance

- Woman & Child Institute

-

Revenue from graduate and undergraduate tuition net of waivers.

-

Historical base funding is used as a starting point for the model. These funds are subject to increasing/decreasing revenues from state appropriations and tuition.

-

The incentive allocation is based on each college’s metrics related to student credit hour foundation, growth in Student Credit Hours, and Professional Master’s Degree Revenue.

-

The foundational student credit hours are the average total student credit hours a college accumulated over AY23 and AY24. This number serves as the foundation for calculating student credit hour growth.

-

A master’s degree which prepares students for entry into a particular occupation and may lead to third-party licensure. Specialty accreditation may dictate coursework and the number of required credits.

-

Each service and support unit constructs its annual budget based on needs and activities for the year. Unlike traditional methods that adjust previous years' budgets incrementally, this approach necessitates an annual assessment of all potential expenditures. Funds will be reimbursed for actuals and units are held to budget rather than cash available. Expenses will be reimbursed based on actuals.

-

Tax appropriations made through the Utah Legislature and tuition and fees are state funds. These appear in various fund types within the University of Utah accounting system, which include funds 1001, 1002, 1003, 6100, 6103, 4907, etc.

-

Funds passed from a VP office to reporting departments and units.

-

State funds that have been carried forward from previous year’s budgets. This is limited to 7% by state regulations.